Bitcoin price: Technical breakout points to rally to $34k

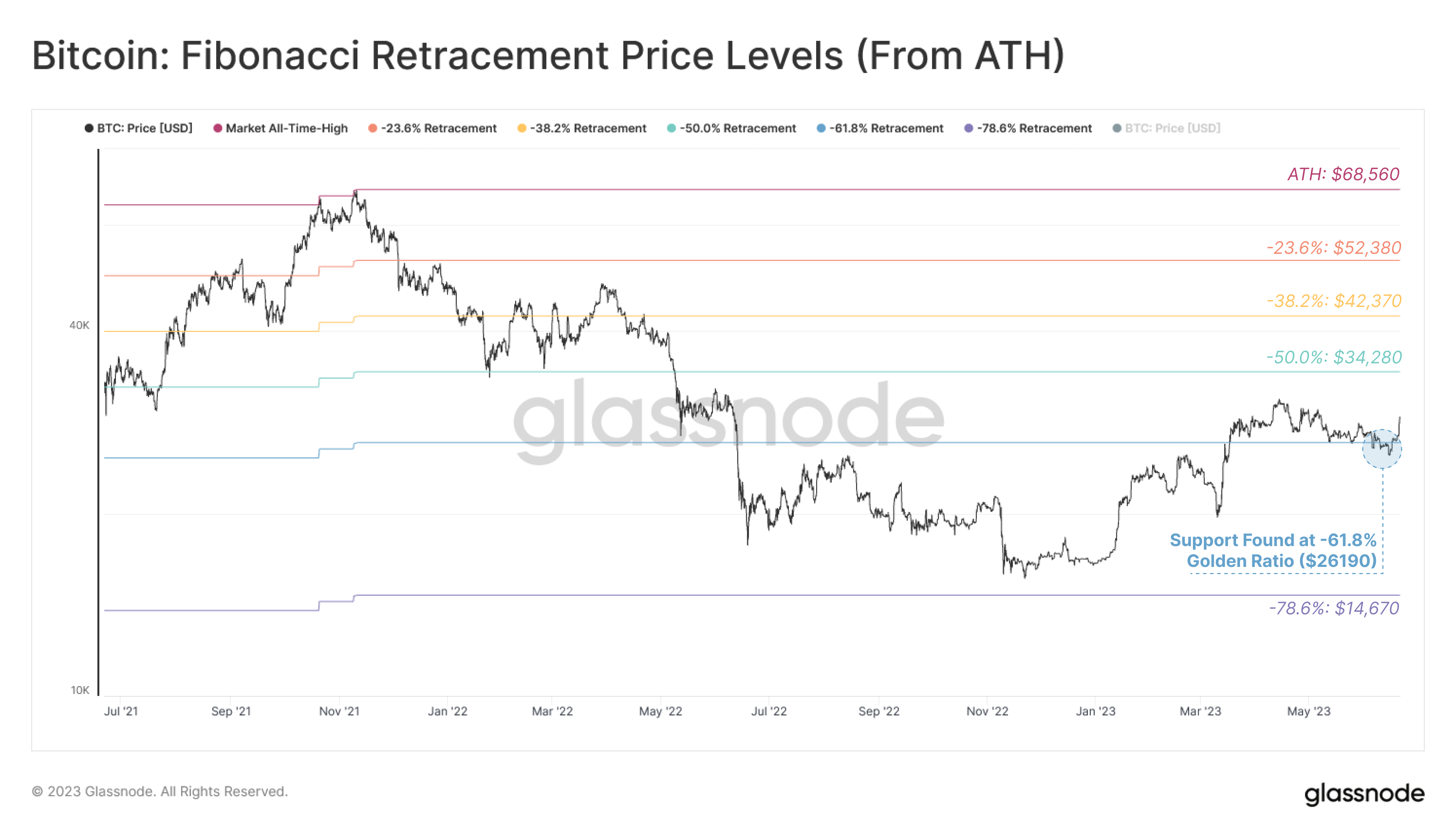

- Bitcoin’s breakout to $29k comes after bulls established $26,190 as a key support zone.

- If bulls break to YTD highs, the next direct resistance per the Fibonacci model could be at the -50.0% retracement of $34,280.

- Bitcoin traded at around $29,030 on Monday morning after spot ETF news sparked by BlackRock’s filing aided bulls’ upside momentum.

Bitcoin (BTC) broke above a key downtrend line as it rose past the $28k level on Tuesday. In reaching the $29k area, BTC pushed well beyond the recent hurdle and now has a key support line of $26,190.

Analysts have pointed Bitcoin’s break of a multi-month downtrend as a bullish move that puts the top crypto asset on the verge of retesting the $30k level. Can it go higher than its year-to-date highs above $31k?

The technical picture based on the Fibonacci model suggests it could pump beyond its YTD highs.

Bitcoin price to $34k next?

While Bitcoin is clearly not in a bull market yet, the potential for a burst is looking likely as a confluence of positive factors align. Given, regulatory headwinds, including the SEC’s lawsuits against Binance and Coinbase, continue to hover over the market.

However, the resilience shown over the past weeks and renewed optimism as major financial institutions embrace crypto has bulls poised and a break to $30k is very much on. Can it go to $34k next?

According to Glassnode, an on-chain and financial metrics data provider, this robust support is at the -61.8% golden ratio Fibonacci retracement. If the price pushes higher and establishes a clear upward trend, it’s likely bulls will retest the bears’ resolve around $34,280.

This would be the next direct resistance zone, Glassnode pointed out on Wednesday, putting this possible supply reload zone at the -50% Fibonacci retracement level.

Chart showing Bitcoin Fibonacci retracement levels from its all-time. Source: GlassnodeHaving survived the negative sentiment that surrounded the SEC’s crackdown, the current wave of buy pressure could bring two other major resistance areas into play.

Chart showing Bitcoin Fibonacci retracement levels from its all-time. Source: GlassnodeHaving survived the negative sentiment that surrounded the SEC’s crackdown, the current wave of buy pressure could bring two other major resistance areas into play.Veteran trader Peter Brandt believes the breakout shifts the “burden of proof” to the bears as he suggests a rally to above $37k is possible. Meanwhile, Glassnode identifies the -38.2% and -23.6% Fibonacci retracement levels of $42,370 and $52,380 respectively as key hurdles.

Currently, BTC/USD is trading at $29,030, about 8% up in the past 24 hours and nearly 12% higher over the past week.