Cryptocurrency price update: Dogecoin, Polkadot – CoinJournal

- Crypto prices largely flat ahead of Fed interest rate decision.

- Dogecoin bulls look to strengthen above key level.

- Polkadot is struggling with downside pressure.

With markets awaiting the Federal Reserve’s rate decision on the afternoon of September 20, the crypto space has Bitcoin and most altcoins poised near key price levels. Bitcoin is above $27,000 while Ethereum is hovering around $1,630.

Analysts say the crypto market could experience some upside volatility amid expectations that the Fed will hold steady and possibly pencil in a further rate hike. This would then be followed by the expected pause.

Stocks were slightly higher as the market awaited the central bank’s decision on Wednesday. What’s the price outlook for Dogecoin and Polkadot today?

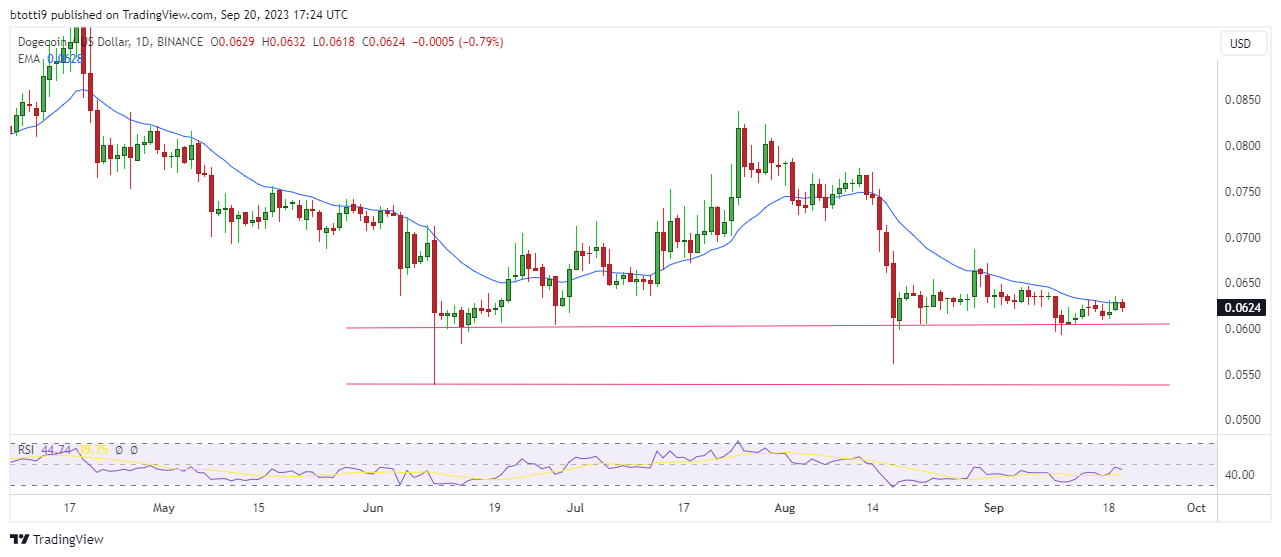

Dogecoin price: DOGE bulls have the upper hand

Dogecoin currently trades around $0.062, a price level close to the 20-day EMA area that’s given sellers some profit-taking perspective.

The OG meme coin has not mastered the traction so hyped, particularly in relation to its potential landing on X (formerly Twitter) as the Elon Musk-supported payment currency. Crowd noise in that regard has faded a little and thus suggests bulls have to battle for control above the said hurdle if they are to reclaim $0.08.

If not, we could see Dogecoin’s price fall to next support in the $0.053 region.

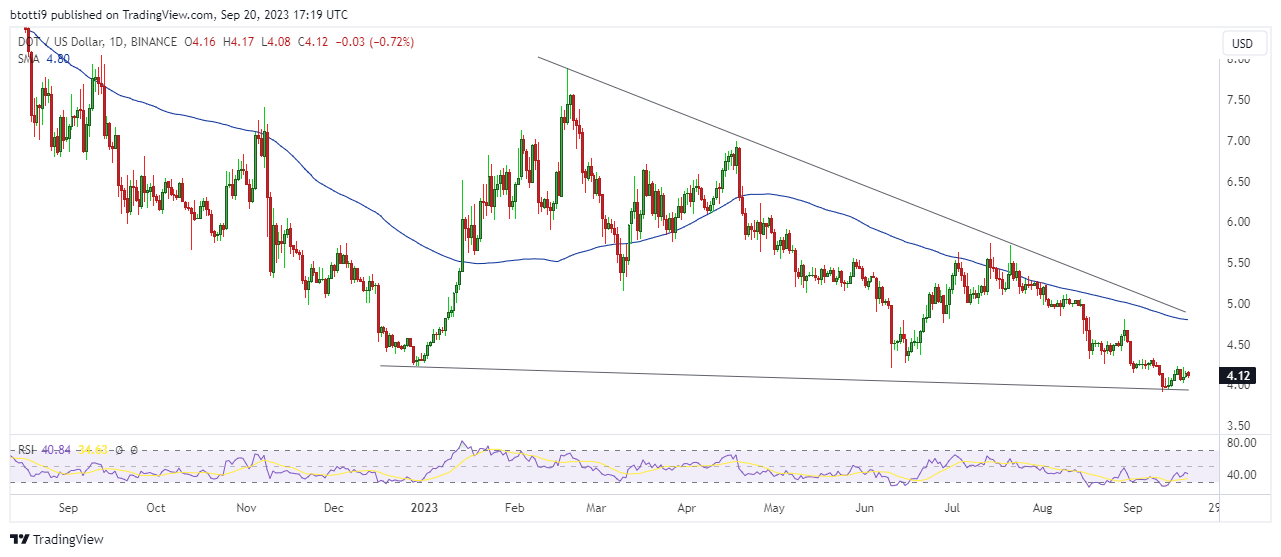

Polkadot price: No joy for DOT

Polkadot has made lower highs and higher lows since breaking lower from near $4.80 in late August. With bulls finding it difficult to keep bears in the woods, DOT has increasingly traded towards a new low. Indeed, DOT/USD recently touched its lowest price since the crash in late December 2022.

While the area around $4.00 offers immediate support, the push to near $3.90 last week suggests seller could still see this as an achievable target. The downslopping 100 SMA and the daily RSI highlight this outlook.

On the other hand, a breakout beyond the 100 SMA ($4.80) could spark fresh upside momentum. The key hurdle would be around $5.50.