1% TDS on Crypto in India | Everything about TDS on Crypto

Indian Govt has introduced a 1% TDS which is applicable on crypto transactions since July 1, 2022. However, there is still a large mass of crypto people who does not understand how, why and when TDS will be levied. Let’s try to understand all the conditions of 1% TDS in simple words.

What is TDS?

The idea of TDS was designed with the objective of direct taxation from the source of income itself, according to the legal description given by the Income Tax. According to this idea, a person (deductor) who is required to make a payment of a certain sort to another person (deductee) must withhold tax at the source and deposit it into the Central Government’s account.

On the basis of Form 26AS or a TDS certificate provided by the deductor, the deductee from whose income tax source contributions have been made is entitled to get credit for the amount so deducted.

TDS ON CRYPTO

TDS, or Tax Deducted at Source for Virtual Digital Assets (VDA), was added to the Income-Tax Act of 1961 under a new provision named 194S in the Finance Bill of 2022. On any payments made for the transfer of Virtual Digital Assets, a 1 percent TDS is stated.

In other terms, when you sell virtual currency on an exchange, that is handling the transaction will withhold and deduct 1 percent of the transaction fee as TDS, which is subsequently paid to the government.

According to Income Tax laws, TDS may not be required if you have completed transactions (both purchase and sell) totaling less than ₹ 10,000. But keep in mind that these restrictions apply to every exchange a user trades on, per user. With effect from July 1, 2022, all exchanges will be obliged to deduct TDS from the first relevant transaction because no exchange would be aware of the trades made on other platforms.

Deduction of TDS

The Central Board of Direct Taxes (CBDT) has instructed that the exchange itself may deduct the tax amount under section 194S.

In simple words, a user wouldn’t need to take any action as a buyer or seller on the exchange. The procedure will be handled by the exchanges. TDS statements will undoubtedly be communicated with users on a regular basis for their records. Users should be aware of the fact that it does not matter if they booked a loss or made a profit, 1% TDS will be levied on sell transactions.

Important points to remember

1% TDS is Levived to track crypto movement, it has nothing to do with profit or loss.

Always remeber..

There is no TDS on:-

1. Depositing ₹ to Exchange.

2. Buying Crypto with ₹

1% TDS will be levied when:-

1. Selling Crypto with ₹.

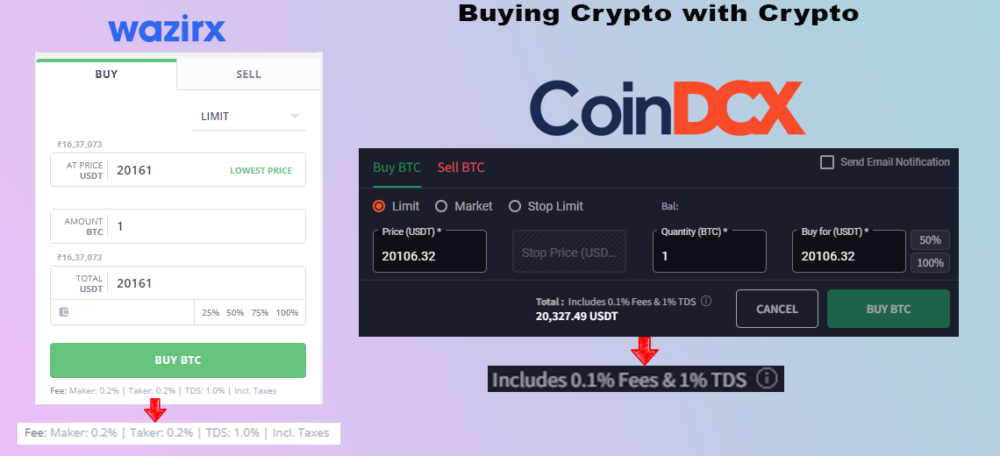

2. Buying Crypto With Crypto.*

3. Selling Crypto with Crypto.*

In point 2 and 3 above the * represents that the 1% TDS will be levied on both sides as Crypto is being moved and TDS is there to track crypto movement.

How TDS will Impact the investors?

Buying Crypto

1- With INR

2- With Crypto

Selling Crypto

1- With INR

2- With Crypto

Important points about 1% TDS

Q: Is 1% TDS mandatory? Can it be avoided?

A: Yes, 1% TDS is mandatory and trying to avoid it would be illegal.

Q: Date of effectiveness?

A: 1% TDS is applicable from July 1, 2022.

Q: Is TDS applicable on selling only or on buying as well?

A: If you are buying crypto using INR, the 1% TDS is not applicable but if you are buying Crypto with Crypto, then 1% TDS will be applicable on both ends. While for selling, 1% TDS will be levied when crypto is being sold for crypto while only the seller will have to pay TDS if crypto being sold for INR.

Q: Who will deduct the 1% TDS?

A: The exchange itself can subtract the 1% TDS from the net selling transaction and pay it straight to the government, according to the Central Board of Direct Taxes.

Q: Do I have to pay 1% TDS even if I pay 30% tax?

A: The 30% crypto tax is only applicable if you profit out, while TDS is there to track crypto movement, any time a crypto is moved 1% TDS is levied. The 1% TDS is deducted on transaction while the 30% crypto gain tax is filled with ITR filing.

Q: Can I claim the TDS charged?

A: Yes, when you file your ITR, you can claim all the TDS that you have paid in that financial year.

Q: Will 1% TDS be applicable on Future trades?

A: No, 1% TDS can not be levied on Future trades as it is applicable on assets and not on contracts and in futures, contracts are traded in place of assets. Along with the futures the 1% TDS is also not applicable on Lend, Stake, earn etc.

Q: How 1% trade will affect the margin trading?

A: As 1% TDS is levied on the final amount, hence, trading in margins will increase the TDS according to the margin taken.