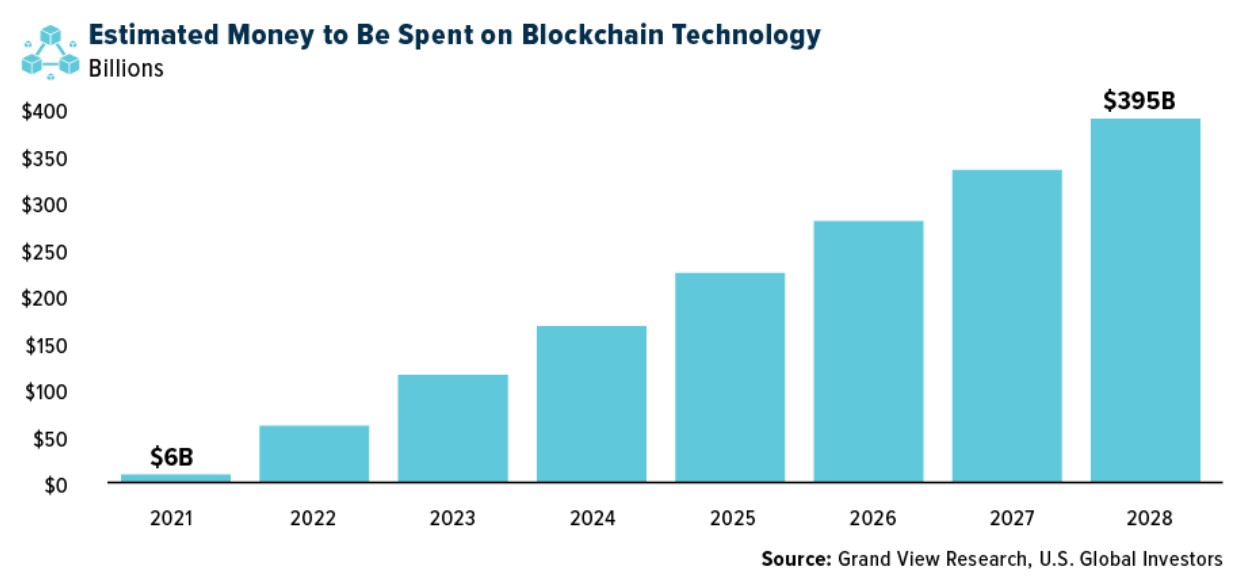

Money to be spent on blockchain technology is set to rise exponentially in the years to come.

- Money to be spent on blockchain technology is set to rise exponentially in the years to come

- Bitcoin will be used to validate everything on the blockchain

- Inverse head and shoulders supports the bullish case for now

The cryptocurrency market is on steroids again, as Bitcoin rallied hard from the 2022 lows. Since bottoming late last year, Bitcoin bulls have pushed hard despite negative news surrounding the industry.

Yet, against all odds, the market kept advancing. Many investors are here for the long term, strong believers in blockchain technology.

Speaking of which, the technology is expected to expand more than 65 times from 2021 to 2028. By that time, the estimated money to be spent on blockchain technology should reach close to $400 billion.

So why not look at Bitcoin as an investment, as it will be used to validate everything on the blockchain?

3 reasons to buy Bitcoin

Bitcoin is up close to 4% today at the time of writing this article. Moreover, it keeps a bullish bias despite today’s gains.

From a technical analysis perspective, there are currently at least three reasons to buy Bitcoin. One is that it is trading above resistance given by the $25,000 level.

Another is that an inversed head and shoulders pattern formed at the recent bottom. The measured move, in orange on the chart above, points to $32,500 and represents only the minimum distance the market should travel to confirm the bottom.

Finally, a pennant formation might be spotted at current levels. Bitcoin moved in a relatively tight range for several days, usually forming ahead of a bullish breakout. A breakout above $30,000 should trigger more strength as the measured move points to $35,000 and beyond.