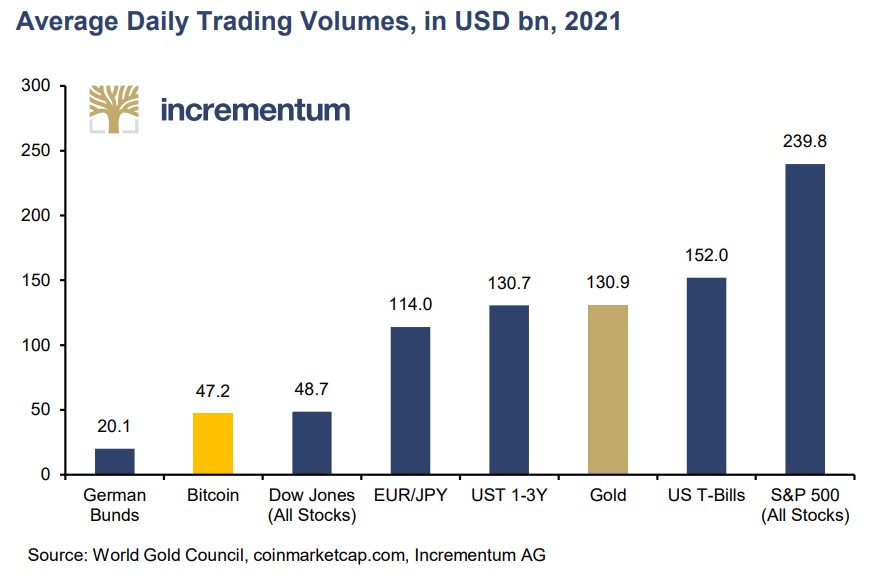

A diversified portfolio with gold and Bitcoin makes sense as Bitcoin’s trading volume rises. Gold’s stability offsets Bitcoin’s volatility.

- A diversified portfolio with gold and Bitcoin makes sense as Bitcoin’s trading volume rises

- Gold’s stability offsets Bitcoin’s volatility

- This way, investors may participate in Bitcoin’s upside potential without compromising on risk parameters

Portfolio management deals with managing risk. All risk cannot be avoided, and a risk-averse investor would not want to take no risk.

Instead, a risk-averse investor would like higher risk-adjusted returns. Naturally, the higher the potential return, the higher the risk.

Investors build portfolios of different assets to find the best possible risk-adjusted returns. Ideally, the assets have a negative correlation, thus bringing diversification benefits to the investor.

But it also makes sense to build a portfolio with correlated assets. While the portfolio is riskier, some other asset properties may appeal to investors willing to take a bigger risk.

As Bitcoin’s average daily trading volume rises, such a diversified portfolio may contain gold and Bitcoin.

Why to add gold and Bitcoin to a portfolio?

Diversified portfolios spread the risk across uncorrelated assets. A portfolio manager’s challenge is finding that diversification level beyond which diversification brings no benefits anymore.

Traditionally, gold’s role in a portfolio is to bring stability. By adding Bitcoin to a portfolio, one may participate in the cryptocurrency’s upside potential and, at the same time, mitigate the risk associated with Bitcoin’s volatility by combining it with gold.