Bitcoin waits for central banks to move before breaking the current range

- Bitcoin is in a 10-day long consolidation

- The range is extremely tight

- Market participants await central banks to move

The past ten trading days have been extremely quiet for Bitcoin. It moved in a tight range, trading as high as $24k and as low as $22.5k.

Considering the historical volatility, the range is exceptionally tight. So why is Bitcoin, and other markets, too, moving in such a tight range?

The answer comes from central banks’ monetary policies.

In the following two trading days, three of the most important central banks in the world will release their monetary policy decisions. The Fed in the United States is the first one, followed by the Bank of England and the European Central Bank.

Game-changing market conditions

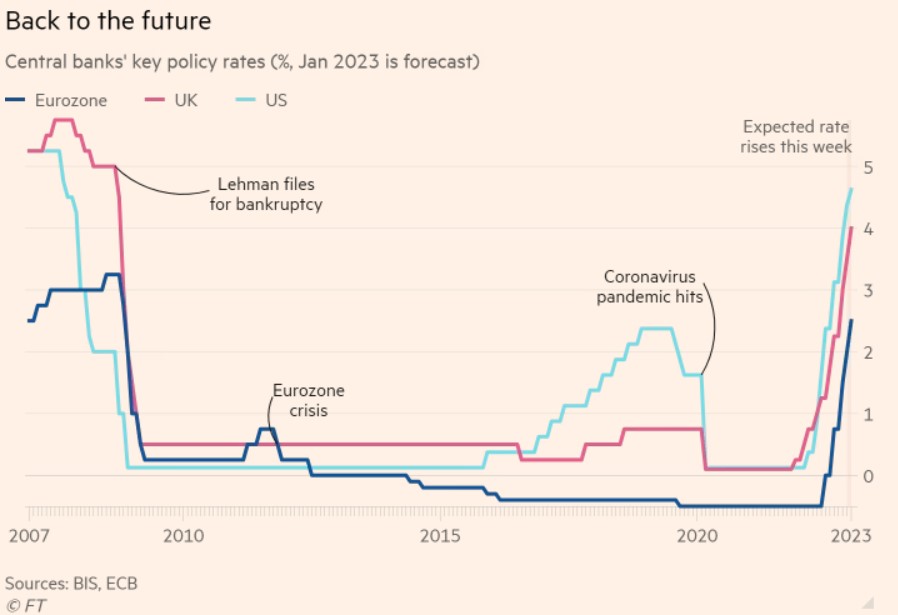

The chart below, courtesy of Financial Times, tells the full story of the current market conditions. All three central banks are expected to raise the interest rates this week after doing so several times before.

The tightening of financial conditions comes in response to high inflation in the developed world. These countries have not seen such inflation in more than four decades, so the central banks’ reaction is understandable.

So why is the US dollar dropping, as reflected by the Bitcoin/USD rate?

The answer comes from the market positioning given the previous rate hikes.

The interest rate in the United States has reached over 4%, while in the euro area is 2.5%. Therefore, the interest rate differential led the common currency, the euro, to weaken against the US dollar.

It traded below 0.96 in the last part of 2022. But this made the euro attractive to investors.

Funds flowed in Europe due to the cheap euro. Moreover, investors ignored the risks associated with the war in Ukraine.

Put simply; the euro was more attractive than the US dollar. So was the British pound.

The dollar’s recent decline reflects these flows. Sure enough, the Bank of England and the European Central Bank still have room to close the gap with the Fed.

But the markets are proactive, and move in anticipation of what is about to come. Therefore, the dollar’s weakness is seen as a result of the Fed slowing the pace of the interest rate hikes, while the ECB does not.

And so, Bitcoin should still gain against the dollar, should the euro do the same.