Binance Coin (BNB/USD) price analysis amid fresh pains in the crypto market

Binance (BNB/USD) sits above a support zone of $266. At the current valuation of $281, BNB has lost 30% since nearly topping $400 a few days ago. A contagion of risks has been responsible for this.

First, the collapse of FTX raised caution about the financial health of crypto exchanges. As a cryptocurrency affiliated with an exchange, BNB was not spared either. Secondly, although the US inflation rate came lower for October, it remains elevated. Further rate tightening is possible despite investors eyeing a softer stance by the Federal Reserve.

With growing risks, Binance is not taking chances. CEO Changpeng Zhao recently announced that the crypto exchange had raised its Secure Asset Fund for Users to $1 billion. The move reassures the market shaken by the collapse of FTX. On November 14, CZ announced the creation of an industry fund. The fund will bail out “strong” crypto firms facing a liquidity crisis.

Amid the growing concerns and developments, BNB bulls are defending $266. The level has become significant since BNB has yet to trade below it since a breakout in July. BNB has a real chance of recovering from this level if the bulls hold ground.

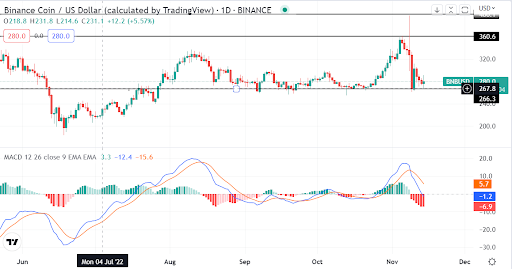

BNB defends $266 amid a weak momentum and bearish MACD crossover

Source – TradingView

Source – TradingView

Technically, we should consider BNB bearish. The momentum is weak, while the recent MACD crossover supports a bearish view.

However, since BNB settled at $266, the price has regained stability. Multiple inside bars can be seen at the key support, indicating indecision in the market.

Should you buy BNB now?

The outlook is mixed for BNB price at the support zone. Bulls are defending $266, but the technical indicators show a bearish market.

If BNB continues to maintain stability, we should watch for the formation of bullish bars at the key support. That could welcome a bullish momentum. Alternatively, a breakout of the inside bar pattern should also attract buyers to the token.

A bullish confirmation should take BNB back to the resistance at $360. We should, however, monitor the crypto sentiment to consider the level around $400 attainable.

Where to buy BNB

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600.

Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

eToro

eToro is a global social investment brokerage company which offers over 75 cryptocurrencies to invest in.

It offers crypto trading commission-free and users on the platform have the option to manually invest or socially invest.

eToro even has a unique CopyTrader system which allows users to automatically copy the trades of popular investors.