We will see if SBF committed financial crimes, says Novogratz

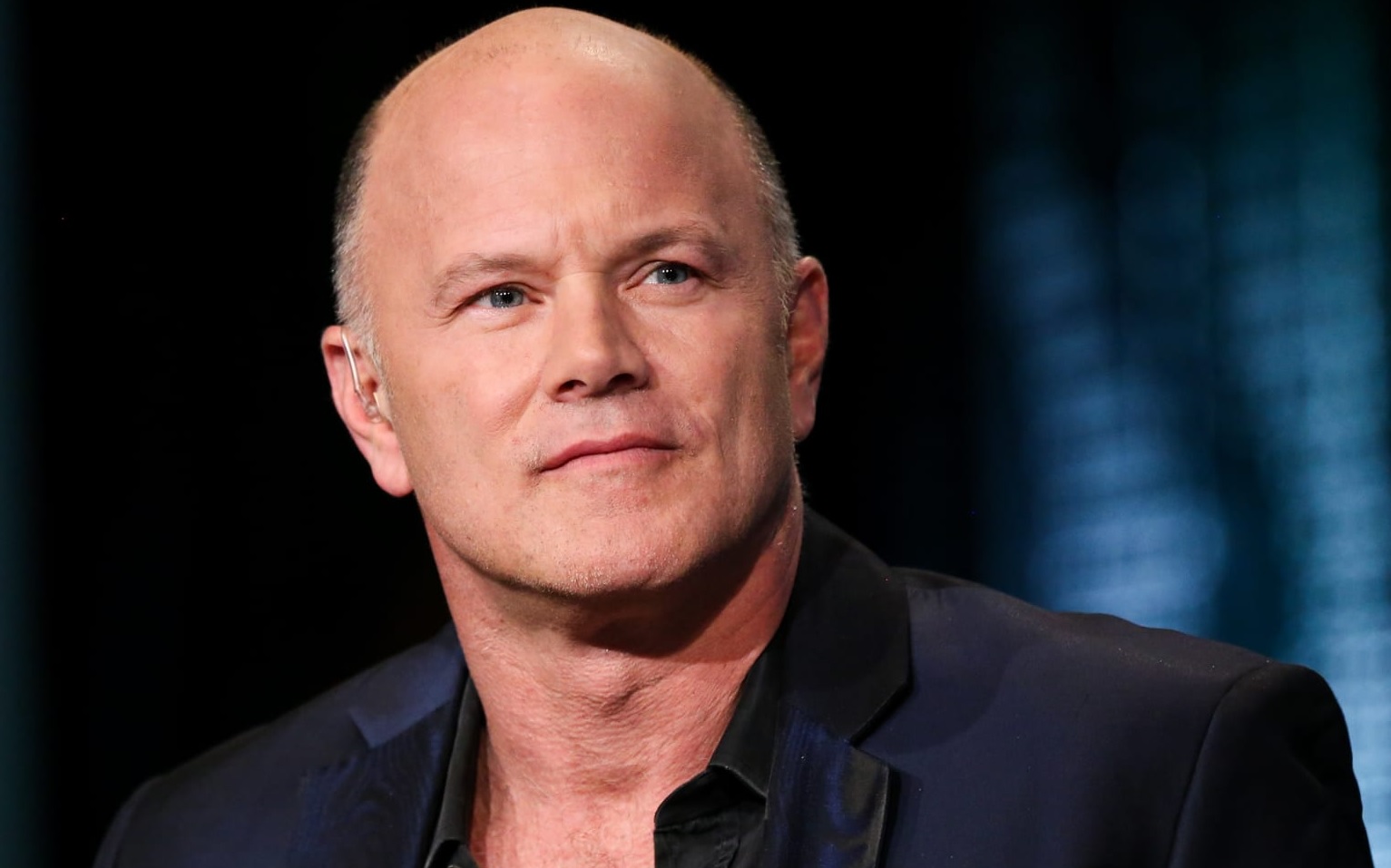

Galaxy Digital CEO Mike Novogratz says time will tell if Sam Bankman-Fried (SBF) is guilty of financial crimes.

Mike Novogratz, the CEO of Galaxy Digital, told CNBC in an interview earlier today that time will tell if SBF is guilty of financial crimes or not.

He mentioned this when asked to explain what happened with FTX. FTX is one of the leading crypto exchanges in the world but is now facing possible bankruptcy.

According to Novogratz, SBF took customer funds from FTX and loaned them out to his hedge fund, Alameda Research. Alameda Research proceeded to use the funds to make illiquid investments such as the bailout and acquisitions of firms such as BlockFi. Novogratz said this about SBF’s move;

“Does it feel illegal? We will see. But it does feel immoral. Regardless, it has been a body blow to the trust in crypto. Markets are all about trust, trust in the system and trust in other counterparties.”

Novogratz added that he is furious with the entire FTX debacle because FTX’s mistake has put a negative dent in the efforts of thousands of other people who are building amazing products in the cryptocurrency space.

When asked if there were any red flags regarding how FTX and Alameda conducted business, Novogratz said there were. He said;

“Looking back now, there were a couple of red flags. I have always wondered where SBF got all the money he was using to make those deals.”

However, he highlighted that with huge investments in Solana and a few other ventures, FTX and Alameda Research could have made around $5-6 billion in profit. Hence, the willingness of many people to overlook his spending and not ask where SBF was getting money from.

Novogratz said Galaxy Digital has $77 million in FTX but is not optimistic about getting most of the money back.

His interview was followed by SEC chair Gary Gensler who told CNBC that investors need better protection in crypto, following FTX’s collapse.

Gensler revealed that the SEC has an ongoing investigation that dates back to the Terra Luna collapse. He pointed out that the incidents are interconnected.

According to Gensler, some key players are at the centre of the crypto space and are controlling most of the activities in the market. However, he pointed out that customer protection has to be a priority in the crypto market.

Binance initially signed a Letter of Intent (LOI) to acquire FTX but pulled out of the deal after taking a look at FTX’s books.