Bitcoin can’t break $20K as only one thing continues to matter

It looks like a bearish finish as we approach the end of the month of September in the crypto markets.

Bitcoin is still lagging below $20,000 as no real momentum has been captured across the space. This outlines my thoughts over the last few months: the only thing that really matters right now is the macro situation.

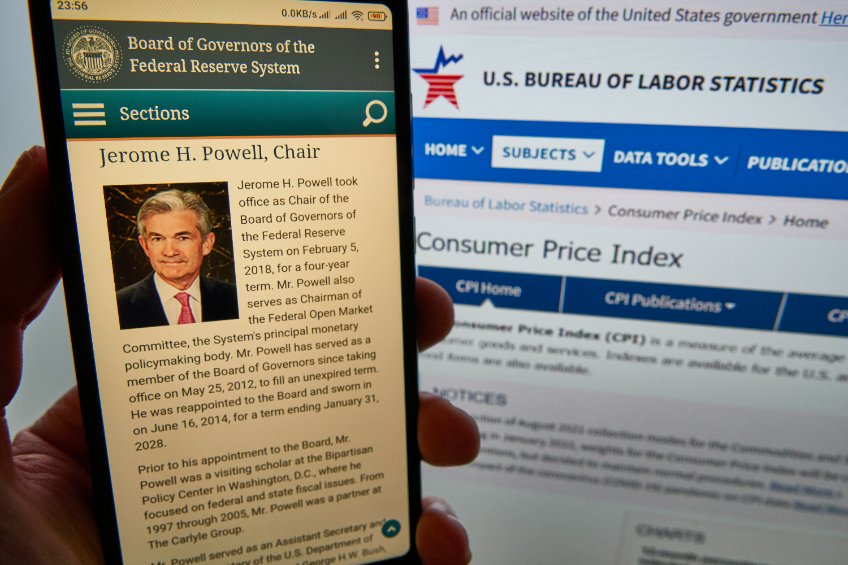

With the war in Ukraine still raging on, energy prices still suffocating the masses and a cost of living disaster refusing to die down, Bitcoin is simply the tail on the dog. It is following the stock market which is following the words of Jerome Powell as the Federal Reserve continues to wage war on the inflation debacle.

I plotted the above chart to show how relatively benign a month it has been by Bitcoin’s standards, as the orange coin feels somewhat range-bound right now. The big spike earlier in the month can be attributed to the market’s thoughts on inflation, as well as the ensuing drop-off.

Federal Reserve continues to move markets

Of course, the catalyst there was yet another FOMC meeting when the Fed’s latest thoughts on inflation are revealed to the market. As rates continue to be hiked in what now appears a staunch position of the Fed to tackle the inflation problem first and foremost, liquidity continues to flow out of risk assets.

This affects the stock market, but it affects crypto assets significantly more given their position further out on the risk spectrum. This is why pretty much every digital asset has been even more tightly correlated in recent months than they normally are.

Even the seminal Merge event on Ethereum was not enough to break the dog-wagging-the-tail problem, as Ethereum barely blipped and just trickled along with the rest of the market.

What does the future hold?

For me, I’m still waiting on the sidelines right now. The macro situation is simply too unpredictable. I feel a harsh winter is in store, especially in Europe, which remains well behind the US regarding rate hikes.

We saw the UK this week announce tax cuts which tanked the pound to an all-time low, such is the concern about its weakness amid continued inflation and a ludicrously strong dollar (which earlier this year achieved parity with the euro and now is not far off doing the same to the pound).

The news nobody wants to hear is that it doesn’t matter what happens in the crypto market, nothing will rise until the macro picture cleans itself up. After a historic bull run lasting over a decade, we need to pay the piper.

The good times can’t last forever. In crypto, we know that more than anybody. The big difference between now and previous cycles is that this time, crypto is in a bear market while the wider economy is, too.

That’s a big change, and it’s very scary.

But for now, we wait and see what the next CPI reading is, and the ensuing reaction from the Fed – and until then, Bitcoin will just truck along tranquilly.