Cobo: Bringing Transparency To Decentralised Finance

[ad_1]

Cobo is a crypto custodian that helps institutions and high-net-worth individuals (HNIs) manage and grow their cryptocurrency holdings by offering infrastructure services like custody wallets, DeFi gateways, and crypto-based yield funds to their clientele.

Institutions that wish to gain crypto exposure can do so in a secure, controlled, and industry-compliant way that minimises the risk of loss due to crypto’s volatility or scammy projects.

Cobo was founded in Beijing by Discus Fish, an early crypto adopter who also founded F2Pool, the world’s largest mining pool, and Changhao Jiang, a PhD in Computer Science and ex-Google platform engineer.

Its infrastructure is integrated with 60 main blockchains and currently manages over $1.5 billion worth of cryptos on behalf of its clients which include crypto exchanges, DeFi protocols, liquidity mining pools, and wealthy individuals.

This review dives into Cobo’s infrastructure, the services they offer, and how institutions and HNIs can benefit from them.

How it Works

Cobo acts as a gateway into the world of crypto and offers services on three fronts.

Crypto Custody

Cobo offers crypto custody services for institutions where they store their cryptos in highly secure vaults with high availability, access controls, and global distribution.

These vaults provide unique features like multi-signature access where two or more people must sign transactions before they are processed and key sharding where a private key is split into multiple pieces and kept in various locations or with different people.

Institutions can create role-based access to their vaults so that qualified team members can access and manage funds.

In terms of compliance, Cobo is licensed by the Financial Crimes Enforcement Network (FinCEN) in the US and as a Trust or Company Service Provider (TCSP) in Hong Kong.

When institutions or HNIs store their cryptos with Cobo, they immediately get access to asset management services that generate yields like liquidity mining and controlled access to certain DeFi protocols.

The vault also comes with access to an NFT minting-as-a-service platform where institutions can mint NFTs securely and connect to marketplaces to trade them.

The vault’s features are powered by a blockchain-based transfer network, called loop, that is built for free transfers and settlements and can be managed from the Custody dashboard or API that can be connected to a custom application.

DeFi for Institutions

Cobo offers controlled access to DeFi protocols for institutions that want exposure to decentralised finance with minimal risk in an industry-compliant environment.

The bulk of Cobo’s DeFi operations involves liquidity mining where they provide liquidity to hand-picked DeFi protocols in exchange for profit. The service provides about 5%-30% of the liquidity on its chosen protocols.

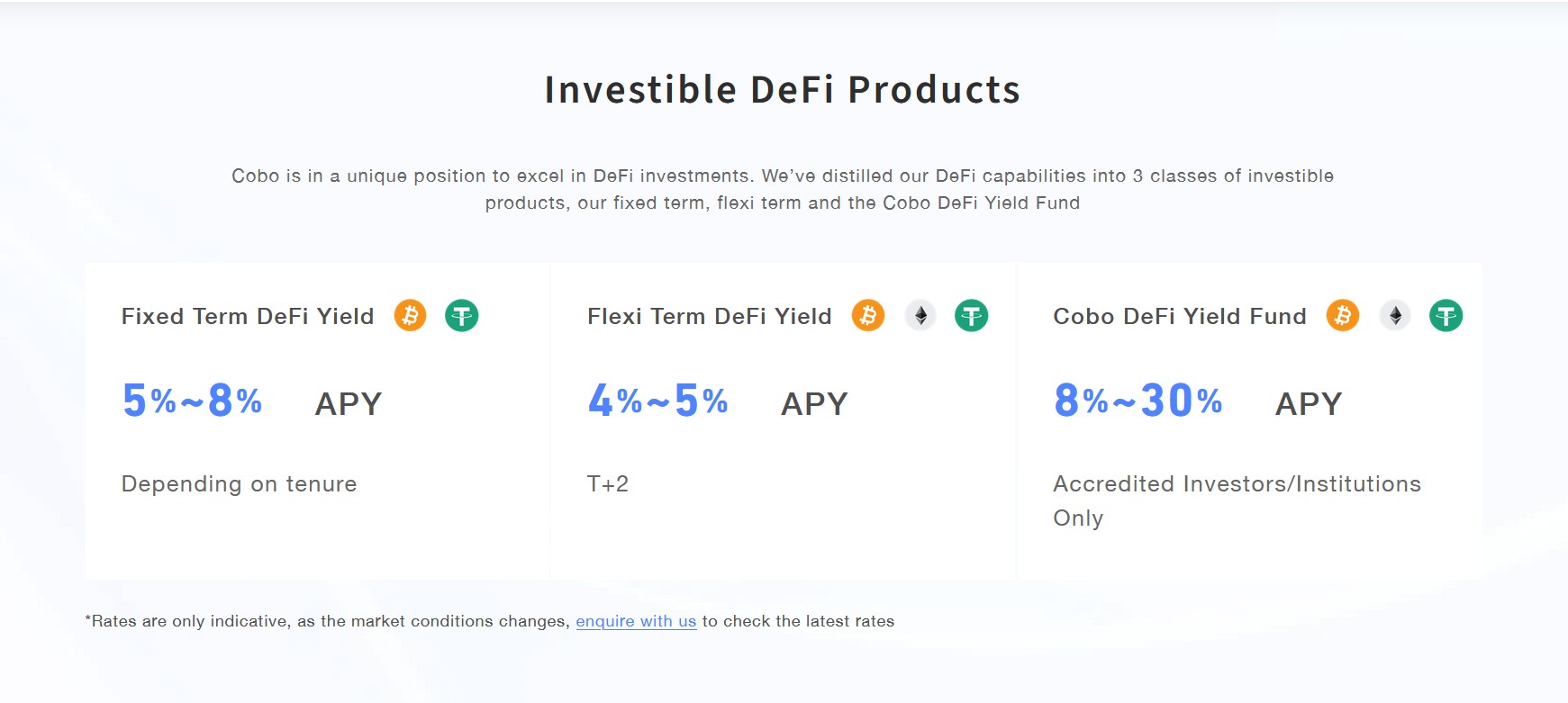

Investors can plug into the profits generated from this activity through three DeFi products:

The fixed term DefI yield offers a yearly return between 5%-8%. Investors lock their funds in protocols for a set period. This product only accepts Bitcoin (BTC) and USDT.

The Flexi term DeFi yield offers a yearly return between 4%-5%. Investors don’t have to lock their funds with this product. They can access their funds at any time, hence the lower yield. This product accepts BTC, Ethereum (ETH), and USDT.

The Cobo yield fund generates a yearly return between 8%-30% on BTC, ETH, and USDT. Investors can choose either a delegated pool that Cobo manages to maximise yield or a dedicated pool created for a specific client that exposes them to a mix of DeFi protocols. Dedicated pools have a minimum fund requirement of $100 million.

Before investing in DeFi protocols, Cobo does its due diligence by first carrying out an on-chain address analysis of various projects to find strong contenders. After the initial analysis comes background checks where Cobo takes apart the tokenomics design to ensure it is solid, runs internal and external audit checks, and assesses the founder(s) background.

If all checks are satisfactory, Cobo then formulates an investment strategy, executes it, and uses on-chain tools to carry out continuous monitoring and risk management.

Wallet-as-a-Service

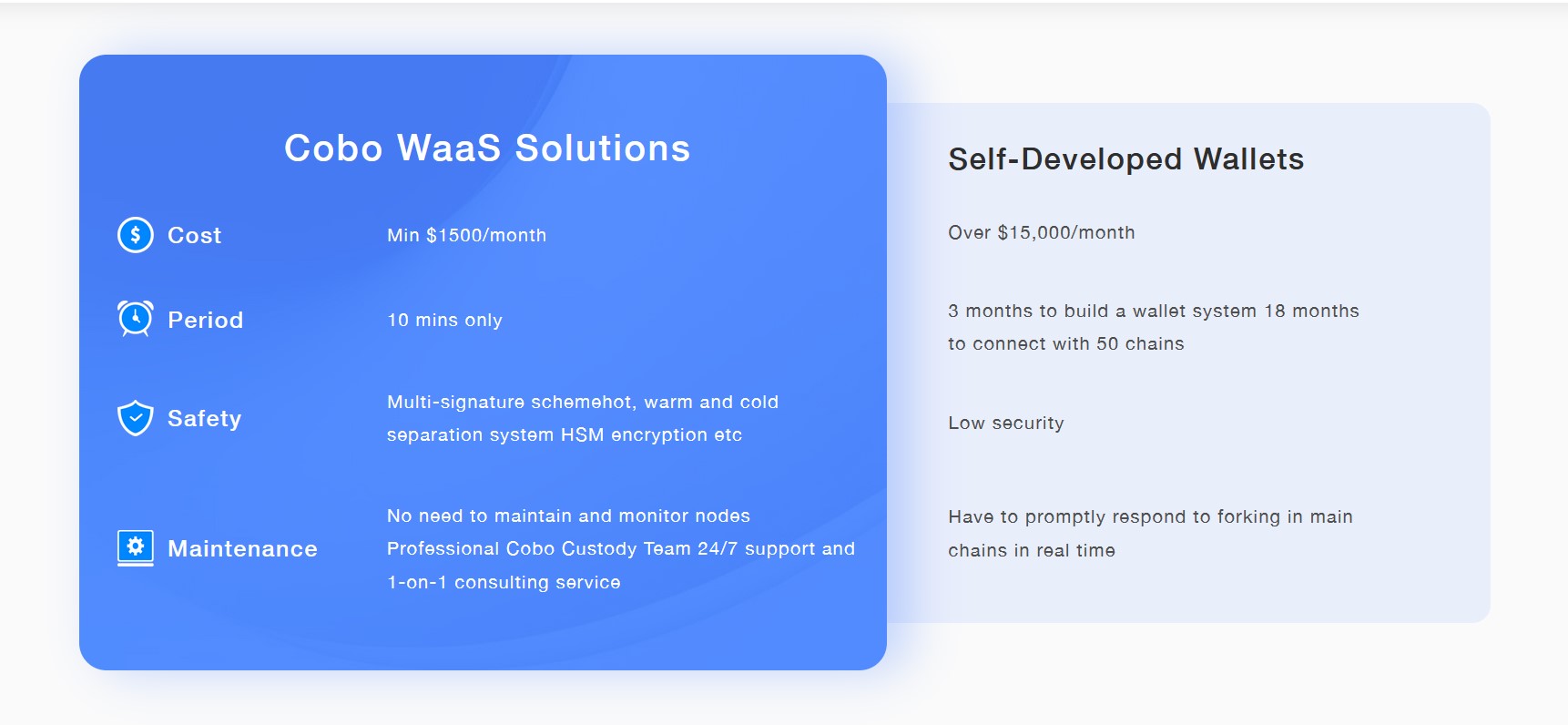

The wallet-as-a-service (WaaS) is a framework that enables institutions to build custom crypto wallets with high security and high availability while Cobo manages all the underlying blockchain technology and functions.

The framework is integrated with 60 blockchains and supports 1,600 cryptos. All institutions need to do is get their developer to set up a wallet and include any custom features. The wallet SDK supports Python, Javascript, Golang, Java, and PHP.

The wallet cost about $1,500 per month compared to a self-developed one that could cost about $15,000 per month, according to their website. Institutions can also set up a wallet in as little as 10 mins compared to hours, days, or even weeks needed to develop a wallet from scratch.

Lastly, Cobo maintains and updates the underlying infrastructure, ensuring that events like hard forks are integrated in real-time.

DeFi-as-a-Service

DeFi-as-a-service (DaaS) is a secure gateway to the world of decentralised finance for institutions that want granular control over their DeFi activities. The main difference between Cobo’s DeFi offering and Defi-as-a-service is that the former doesn’t grant direct access to DeFi protocols while the latter does.

The DeFi service is a group of managed yield products while the Defi-as-a-service is a gateway that allows institutions to interact with DeFi protocols directly.

The service provides tools that not only connect securely to protocols but also allow institutions to set up role-based access, custom workflows, on-chain monitoring, and multisig access to DeFi protocols on public blockchains.

DaaS is offered in three forms: the centralised form, the smart contract form, and the dedicated blockchain form.

The centralised form grants access to DeFi protocols and NFT marketplaces while abstracting the underlying infrastructure concerns. It comes with fiat on/off ramps, workflows, and compliance and audit features.

The smart contract form comes with a module that plugs into a safe on the Gnosis network, a prediction market on the Ethereum blockchain. This form comes with continuous on-chain risk management, custom workflows, and alerting features.

The dedicated blockchain solution supports cross-chain asset management and comes with role-based access and completely custom workflows.

Key Features

Military-Grade Security

Cobo’s security architecture is industry standard with 3-tier private key layers and ISO27002 certification, a global standard for information security, in the works. Their DeFi gateways are also secured with the same technology and feature multi-signature access to eliminate single points of failure.

Custom Workflows

Institutions can integrate an already existing sequence of processes with Cobo’s software to maintain productivity and industry standards. These workflows can be customised on a smart contract level to enable features like monitoring and on-chain risk management.

Role-based Access

Complex institutional structures rely on roles with strict limits to maintain order. Cobo’s role-based access feature creates various layers or degrees of access to the infrastructure and products. This way, the only people with access are the ones the institutions approve.

Continuous Monitoring and Risk Management

Crypto is volatile and as such, institutions need to stay on top of their investments. Continuous monitoring and risk management allow them to react to price volatility in real-time.

Pros and Cons of Cobo

Pros

Tight security as infrastructure is military grade and private keys are globally distributed

Licenced in the US, Hong Kong, Singapore, Europe, The UAE, and the Cayman Islands

Affordable as they manage all the underlying infrastructure

Industry-compliant systems and processes

Compliant with AML/KYC/KYB/CFT regulations

Cons

Why Should You Use Cobo?

Cobo is a one-stop shop for institutional crypto needs that stand out from their competitors in the innovative products they offer. While many other custody services simply store clients’ cryptos, Cobo grants access to several products to help grow their funds.

Another way Cobo stands out is the way they generate yield. Similar institutional services create derivatives like ETFs that track a basket of cryptocurrencies while Cobo provides liquidity to projects on the ground.

This method is superior to ETFs because market downturns could erode significant portions of the ETFs’ value. This same downturn is less likely to affect Cobo because, as long as the protocols they provide liquidity to are in use, Cobo generates returns.

Cobo also saves their clients potentially millions in blockchain transaction fees through their loop network.

Lastly, Cobo’s on-chain monitoring, custom workflow, role-based access, multisig wallet, and compliance and audit features give institutions the tools they need to carry out transparent transactions that are in line with regulatory requirements.

Verdict

Cobo provides effective tools and infrastructure that bring the transparency and compliance of traditional finance to decentralised finance. Its services are potent for both traditional and crypto-native institutions like hedge funds that want DeFi exposure or crypto exchanges that want cold storage services.

Its other offerings provide a way for institutions to truly participate in the new Web3 safely.

[ad_2]

Source