DigiByte (DGB) swings 30% up in 24 hours in an extraordinary bullish breakout

[ad_1]

DigiByte (DGB) has surged over the last 24 hours in what appears to be a decisive bullish breakout. The coin has also been rising over the past month and has reclaimed a lot of losses seen this year. But how much momentum does it actually have? More details are below but first, here are some important points:

DGB is up around 90% over the last 30 days and over 100% in 14 days.

The coin had managed to post 30% gains in 24-hour intraday trading.

There however remains a serious risk of a sell-off

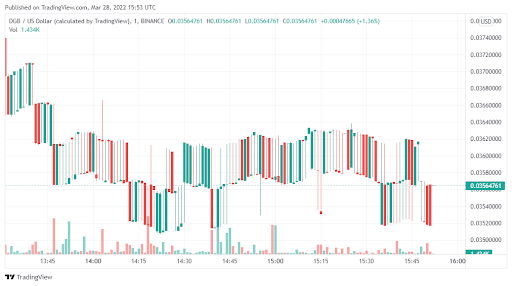

Data Source: Tradingview

Data Source: Tradingview

DigiByte (DGB) – Analysis of this uptrend

For the most part of 2022, DigiByte remained largely on a downtrend with a few bursts upwards here and there. But in the last 14 days, it seems the coin has just shot up, gaining nearly 90%. DGD is now testing $0.4. The last time it did this was in June last year.

The $0.4 mark will be a decisive resistance level. We expect investors to start locking in profits at around that price and as such, it is highly unlikely that DGB will cross over. Also, looking at the 3-day chart, the coin is poised for a significant pullback.

While this may not happen in a few days, overall, we expect DGB to be firmly rejected at $0.4 and will firmly fall towards $0.28 in the near term. This will be a downswing of more than 30%.

Is DigiByte (DGT) worth buying now?

The momentum that DGB has built over the last 14 days is about to slow. The coin is currently at $0.36. We believe the upside based on the chart is capped at $0.4. It wouldn’t, therefore, make any sense to buy now.

However, please watch the rejection at $0.4. DGB is likely to fall back by at least 30% to around $0.28. This would be the best price to enter once more.

[ad_2]

Source